However, the Indian central bank’s hawkish stance toward monetary policy to check inflation, along with its efforts to reverse the pandemic-era cushioning of the country’s economy, are expected to make the Indian rupee stronger against the US dollar. The April inflation rate was the highest since May 2014 for the country, and higher than market predictions of 7.50%. The annual inflation rate in India rose to 7.79% in April, according to data released by the National Statistical Office. Inflationary pressures, driven by the higher prices of food and fuel due to the Russia-Ukraine war and the Shanghai lockdowns this year, have weakened the INR further. The growth was largely as a result of merchandise trade deficit, which swelled to $20.11bn from $15.29bn in April 2021. India’s overall trade deficit, which includes merchandise and services, stood at $8.08bn in April 2022, widening from $6.86bn in April 2021. Higher import costs and a rising current account deficit have also played a significant role in the Indian rupee weakening. A rise in interest rates in the US will result in further outflows.” Domestically, we are witnessing an outflow of funds as investors move funds to high-yielding investment instruments. “The weak economic data around the world, especially in China, has put pressure on the dollar index, which hit a nearly two-decade high. Oktay Kavrak, director of product strategy at Leverage Shares shared his views:

Higher employment shows greater demand for the country’s goods and services, and hence indicate a strong domestic currency. This stellar rise in non-farm payroll employment in the country was indicative of the economic rebound from the pandemic’s impact.

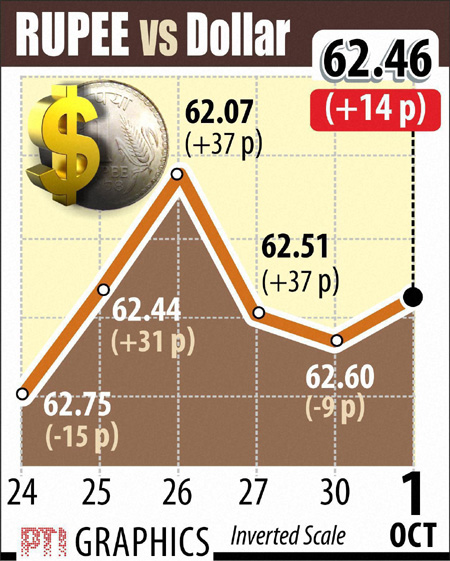

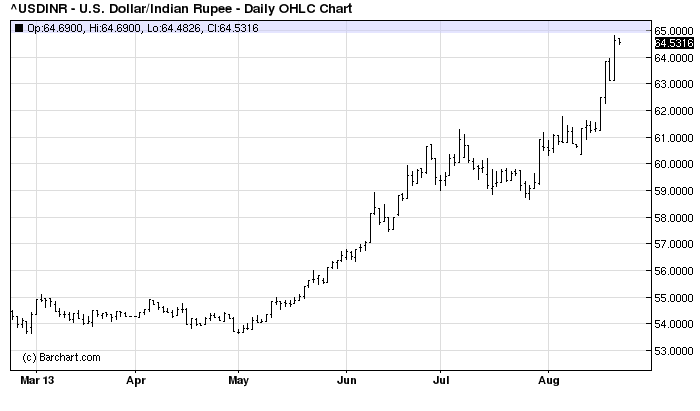

The solid jobs growth was broad-based and encompassed every major industry in the country. The unemployment rate was unchanged at 3.6% during the reported period. Now, as the US central bank tightens its monetary policy, investors are expected to consider pushing their money into the US, further raising the greenback’s demand and solidifying its value.Īdditionally, the US payrolls increased by 428,000 in April, along with a 5.5% rise in average hourly earnings from a year earlier, according to the US Bureau of Labor Statistics. The rate hike earlier in May was the largest since 2000, and came after a 0.25 percentage point raise in March – the first rate hike since December 2018. The Fed’s hawkish stance toward its monetary policy has boosted confidence for further US investment.Īlong with raising interest rates by 50 basis points to a range of 0.75% to 1% on 4 May, the US central bank is expected to raise rates seven times throughout this year to reach 2.9% in early 2023, as projected by The Economist Intelligence Unit. The strength of the US dollar was a result of risk-off sentiment that came partly from concerns over the US Federal Reserve’s ( Fed) capability to check high inflation, which raised the US dollar’s appeal as a safe-haven currency. The dollar index ( DXY), which stood at 102.27 as of writing (25 May) against a basket of major currencies, was at 104.610 on 13 May, its highest since December 2002. We will also take a look at the opinions of some leading analysts about the pair, and their USD to INR prediction for the rest of 2022, as well as the period up to 2030 for the USD/INR trend. In this article, we analyse the recent macroeconomic events that led to the depreciation of the Indian rupee against the US dollar. This decline was driven by a string of factors, including the increasing inflation and higher interest rates, coupled with an exit of overseas investors from the Indian markets and a plunging stock market. The value of the Indian rupee (INR) against the US dollar (USD) has depreciated since the beginning of this year, marking a decline of 4.1% at the time of writing on, from its value on 1 January 2022. Dollar to INR forecast: What lies in store for the pair in 2022? Photo: KayRay /

0 kommentar(er)

0 kommentar(er)