There are 8 steps to buying a house and by using this calculator you’ve completed step 2 (calculating your home affordability) and maybe even step 1 (getting your finances in order). By reducing your debt-to-income ratio (DTI), lenders will see that you comfortably afford your mortgage and be more willing to offer a lower interest rate. If you’re not planning on buying a home for a while, improving your credit score is a tried and true way of increasing your chances of qualifying for a lower interest rate. The introductory interest rate for ARMs is typically lower than the interest rate for a conventional fixed-rate mortgage which makes it a great way to save on interest if you know you won’t keep the mortgage for long. Once the set introductory period ends, the interest rate adjusts (sometimes it goes up, sometimes down). An ARM offers a low fixed interest rate for a set introductory period-typically 5, 7, or 10 years. If you think you may sell or refinance the home in the first 5-10 years of the mortgage, you could consider an adjustable-rate mortgage (ARM). Buying points essentially means you agree to pay more upfront costs in exchange for a lower monthly payment.

If you intend on keeping your home for a while, you could consider buying points to reduce your interest rate. Depending on your loan amount, a lower LTV may increase the likelihood of you of being offered a low interest rate. The amount of your down payment compared to the total amount of the loan is called your loan-to-value ratio (LTV). Increasing your down payment can be one way to help you qualify for a lower interest rate. This mortgage calculator shows your mortgage costs with PMI However, to ensure your home is covered for damage caused by fires, lightning strikes, and natural disasters that can affect your area, most people would recommend keeping it.

ONLINE MORTGAGE CALCULATOR FREE

Lenders do this because they know from experience that no one wants to pay a mortgage on a property that’s burned down, damaged, or destroyed.įun fact: When you own your home free and clear, the decision to keep homeowners insurance is all yours. Your lender will typically insist on you having homeowners insurance while you’re paying off your mortgage. If you fall behind on your property taxes, you could end up losing your home to your local tax authority. Once your mortgage is paid off, you’ll still be required to pay property taxes. These services include schools, libraries, roads, parks, water treatment, the police, and the fire department. The property taxes you pay help fund the services your local government provides for the community. Often these costs will be rolled in with your mortgage payments as it’s important-to both you and your lender-that these bills stay current to protect your investment. When you own a home, you’re responsible for paying property taxes and homeowners insurance. Buying in an area with a lower property tax rate may make it easier for you to afford a higher-priced home. To see how much home you can afford including these costs, take a look at the Better home affordability calculator.įun fact: Property tax rates are extremely localized, so 2 homes of roughly the same size and quality on either side of a municipal border could have very different tax rates. The only amounts we haven’t included are the money you’ll need to save for annual home maintenance/repairs or the costs of home improvements. If you’re thinking about buying a condo or into a community with a Homeowners Association (HOA), you can add HOA fees. As the costs of utilities can vary from county to county, we’ve included a utilities estimate that you can break down by service.

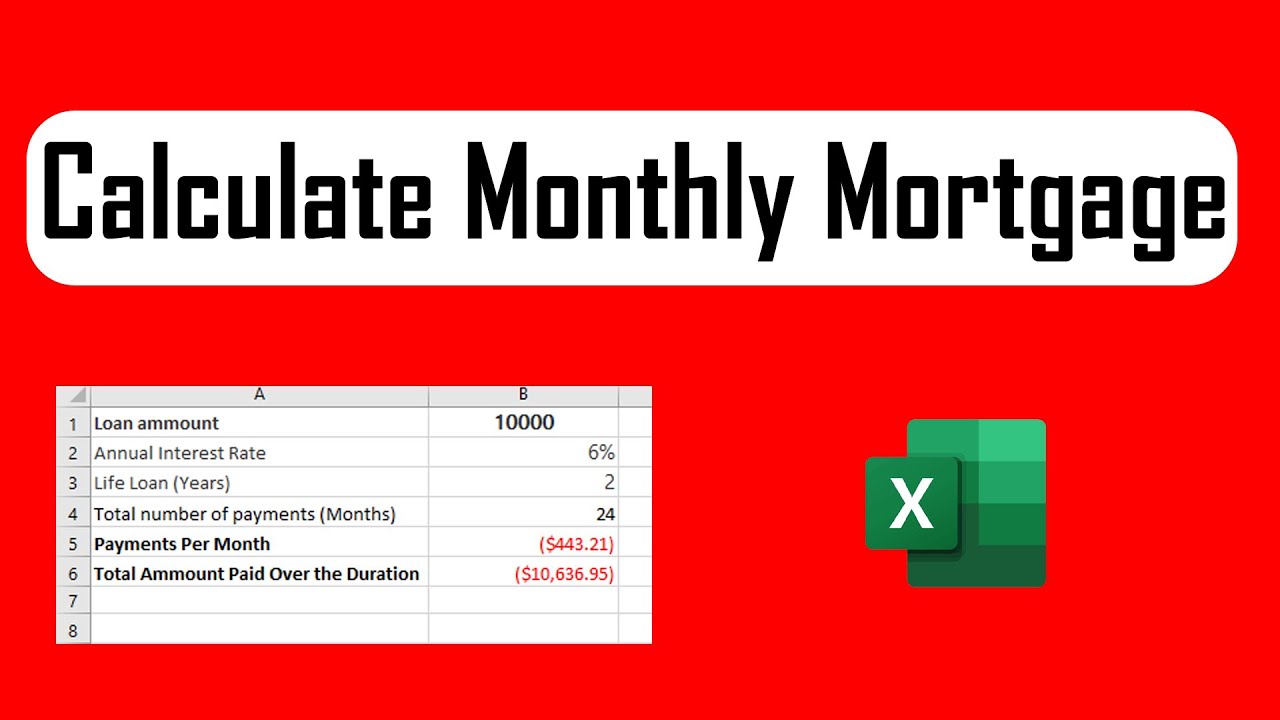

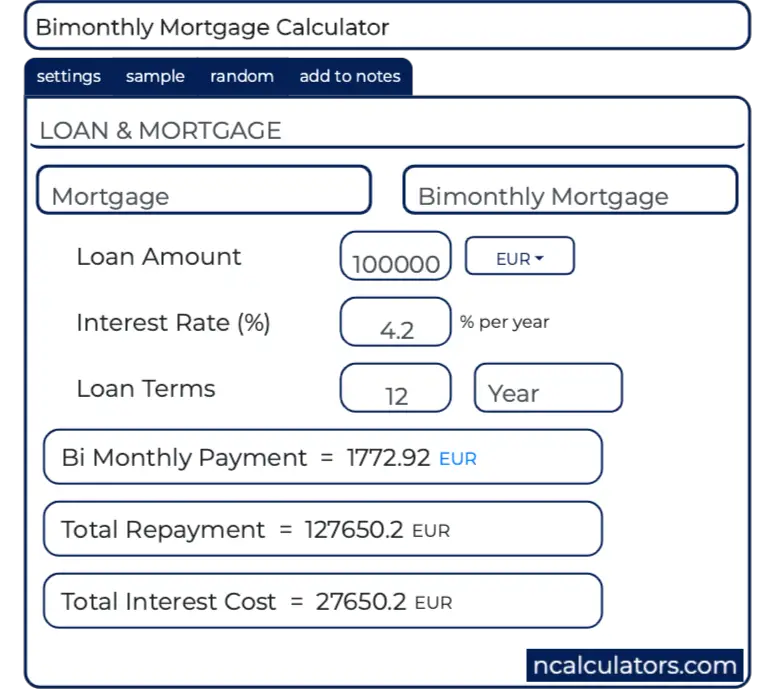

If you enter a down payment amount that’s less than 20% of the home price, private mortgage insurance (PMI) costs will be added to your monthly mortgage payment. Play around with different home prices, locations, down payments, interest rates, and mortgage lengths to see how they impact your monthly mortgage payments. So you can really crunch the numbers, we’ve included all the typical monthly costs you’ll be responsible for once you own a home. Your monthly mortgage costs include more than just loan payments and interest.

0 kommentar(er)

0 kommentar(er)